Tsp withdrawal calculator

And hopefully not run out. Footnote 2 A withdrawal.

Tsp Calculator Store 55 Off Www Wtashows Com

John reached age 70½ on August 20 2019.

. The option you may pick a full withdrawal would be conducted using TSP-70 form or you may choose a partial TSP withdrawal. I used the calculator making the following assumptions. IRA TSP or brokerage account.

The amount of taxes withheld on TSP withdrawal varies depending on how you withdraw the money. You can make your first withdrawal by December 31 of the year you turn 70½ or 72 if born after June 30 1949 instead of waiting until April 1 of the following year which would allow the distributions to be included in your income in separate tax years. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees.

Over the last several years the interest rate has been as high as 3125 November 2018 and as low as 1375 September 2016. College Savings Calculator 529 Savings Plan Overview. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees.

There is a big difference though in how much is withheld from your TSP payments for federal income tax. Tsp or 24 grams g of added sugar daily and men consume no more than 9. AARP 401k Savings Planning Calculator.

Earnings distributions prior to age 59 12 are subject to an early. Dollar figures are rounded to the nearest hundred. Bankrates mortgage refinance calculator Written by.

â œDistribution â œ payment â and withdrawal all mean the same thing. Limits Apply to Two Plans These limits apply to any 403b and 401k accounts a taxpayer might have during the year. It offers the same type of savings and tax benefits that many private corporations offer their employees under 401k plans.

The early withdrawal penalty for a traditional or Roth individual retirement account IRA is 10 of the amount withdrawn. TSP Investors Handbook New 7th Edition. Page Last Reviewed or Updated.

He must receive his 2019 required. Do I have to report TSP withdrawal on taxes. Exception to 10 Additional Tax.

So first of all if you are not a part of an employer-sponsored planso like a 401k TSP plan something like thatthere is no limit on whether or not you get a deduction for your contributions to an IRA. All withdrawals are subject to a mandatory 20 federal income tax withholding unless the funds are transferred directly to a traditional IRA. Exceptions to the 10 Percent Early Withdrawal Penalty.

This hypothetical illustration assumes an annual salary of 75000 pre-tax contribution rates of 6 and 10 with contributions made at the beginning of the month and a 6 annual effective rate of return. Learn about possible sugar detox symptoms and how to manage sugar withdrawal. Withdraw all or some of your TSP funds You could elect a partial withdrawal a series of monthly payments a full withdrawal or a mixed combination of withdrawal options.

Also you may owe income tax in addition to the penalty. We look beyond the conventional wisdom to craft a personalized investment withdrawal amount based on your age when withdrawing from a 401k IRA TSP or brokerage account. As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew.

See IRC Section 72t10 as amended by the Defending Public Safety Employees Retirement Act PL. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. One of the options you have when you use the TSP withdrawal calculator available through the Thrift Savings Plan website is to better understand what TSP Annuity options are available to you.

Individuals must pay an additional 10 early withdrawal tax unless an exception applies. Such as the TSP. Jeff Ostrowski Senior Mortgage Reporter for Bankrate Jeff Ostrowski covers mortgages and the housing market.

The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. In 2020 Americans who experienced adverse financial consequences due to the pandemic were allowed to withdraw up to 100000 without having to pay a 10 early withdrawal penalty. The Thrift Savings Plan TSP is a Federal Government-sponsored retirement savings and investment plan.

To explore annuity estimates based on a different type of annuity purchaseor an annuity purchase combined with other withdrawal optionsyou can use the TSP payment and annuity calculator. You may have to devote some time to tracking your contributions to your 401k and 403b plans to make sure that you dont contribute more than the amount allowed if you have two or more jobs or if you switch jobs in the middle of the year. The following COVID information was for 2020 Returns.

The key question that will likely determine your.

Tsp4gov Want To Design A Savings Plan That S Right For You Our Calculators Can Help Https Www Tsp Gov Planningtools Index Html By Thrift Savings Plan Facebook

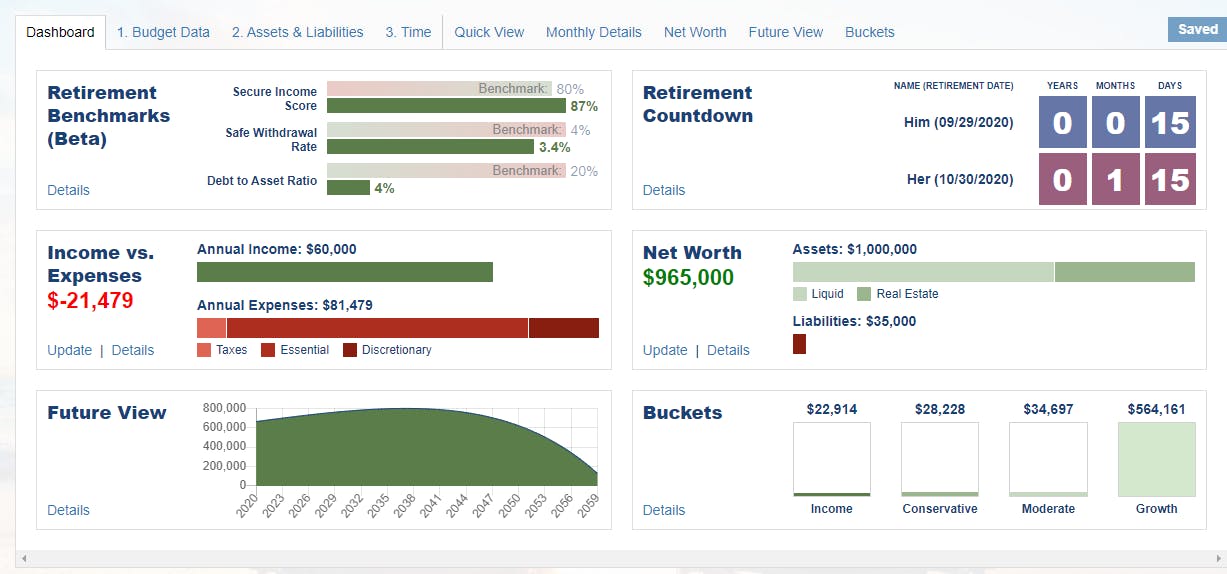

Retirement Calculator When Can I Retire Retirement Budget Calculator

Retirement Withdrawal Calculator For Excel

Fers Calculator Your High 3 Youtube

Tsp Calculator Store 55 Off Www Wtashows Com

Tsp Calculator Store 55 Off Www Wtashows Com

Tsp Calculator Best Sale 57 Off Www Wtashows Com

Tsp Calculator Shop 53 Off Www Wtashows Com

Retirement Withdrawal Calculator

Calculator Retirement Plan Withdrawal Milspouse Money Mission

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Military Retirement Pay Calculator Military Onesource

Tsp Calculator Shop 53 Off Www Wtashows Com

Tsp Calculator Store 55 Off Www Wtashows Com

Start Planning With Our Fers Retirement Calculator Retirement Benefits Institute Retirement Calculator Retirement Benefits Retirement Planner

Tsp Waives Penalties For Coronavirus Related Early Withdrawals Joint Base San Antonio News

Want Clarity So You Can Retire Watch This Video Csrs Service History And Catch 62 To Exchange Conf Federal Retirement Retirement Benefits Investment Advisor